AU NAT 3092 2019-2026 free printable template

Show details

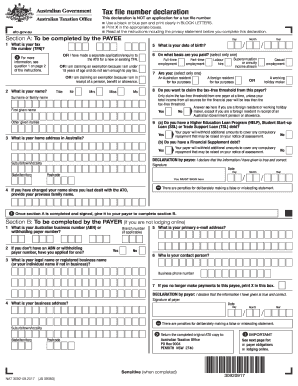

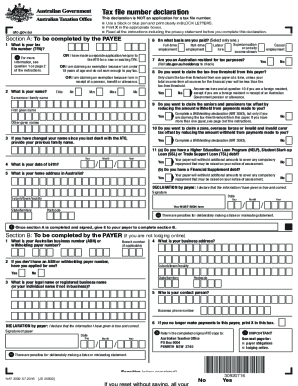

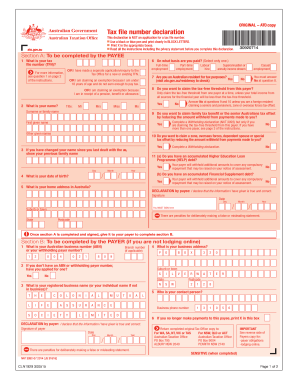

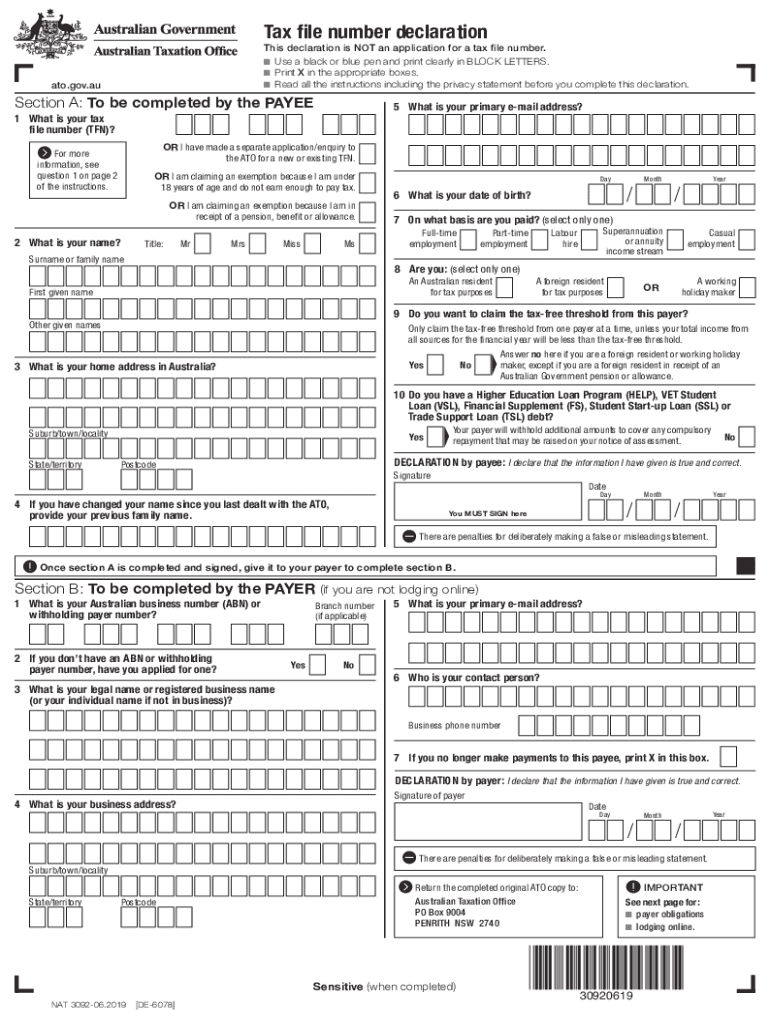

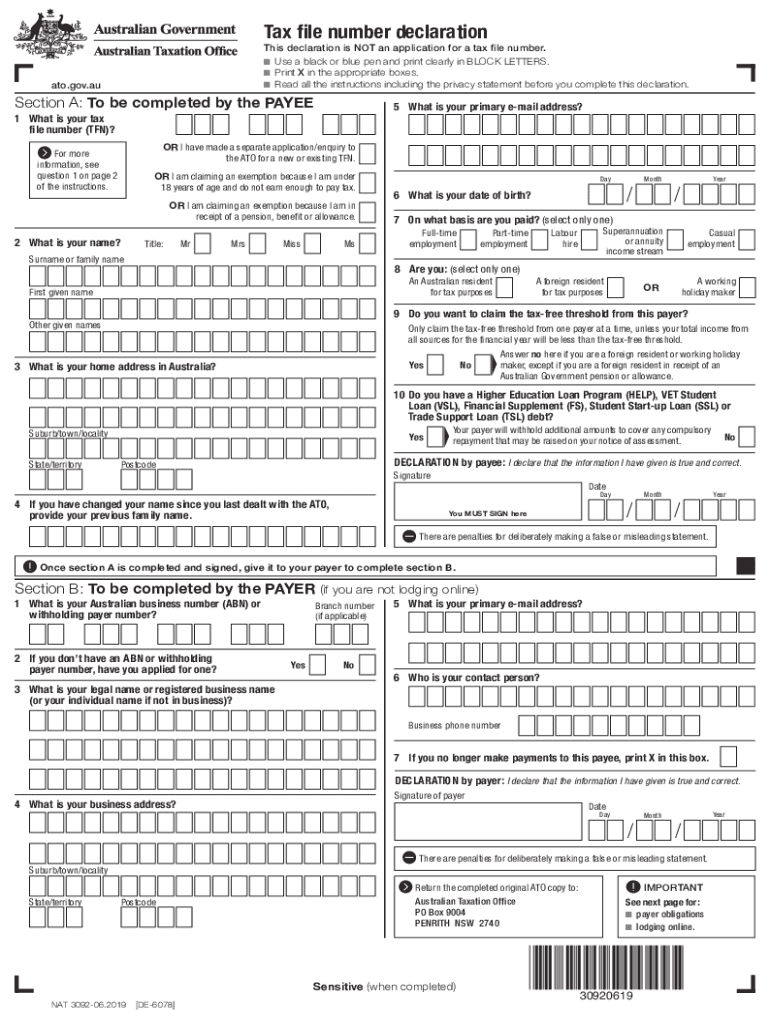

Instructions and form for taxpayers Tax file number declaration Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you. NAT 3092-06. 2019 You don t need to complete this form if you are a beneficiary wanting to provide your tax file number TFN to the trustee of a closely held trust. Scanned forms must be clear and not altered in any way. If a payee submits a new TFN declaration NAT 3092 you must retain a copy of the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tfn declaration form

Edit your tax declaration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax file number declaration form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tfn declaration form pdf online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax declaration form pdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 3092 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax file number declaration form

How to fill out AU NAT 3092

01

Obtain the AU NAT 3092 form from the official website or your local immigration office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details in the designated sections, including your name, address, and contact information.

04

Provide details about your visa status and any relevant immigration history.

05

If applicable, include information about your family members who are also submitting the form.

06

Review your completed form for any mistakes or missing information.

07

Prepare any additional documentation needed to support your application.

08

Submit the form as instructed, either online or by mail.

Who needs AU NAT 3092?

01

Individuals seeking a specific visa related to study, work, or travel in Australia may need to fill out AU NAT 3092.

02

Those applying for a partner visa or related immigration processes may also require this form.

Fill

tax declaration form 2025

: Try Risk Free

What is nat 3092 tax file declaration form?

NAT 3092-07.2016. Instructions and form for taxpayers. Tax file number. declaration. Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you.

People Also Ask about tax file declaration form pdf

What is form 8453 C used for?

Form FTB 8453-C, California e-file Return Authorization for Corporations, is the signature document for corporate e-file returns. By signing this form, the corporation, electronic return originator (ERO), and paid preparer declare that the return is true, correct, and complete.

Can you fill out tax forms digitally?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return.

What is a tax file number declaration form for?

TFN declaration Each of your employees should complete a Tax file number declaration. This allows you to work out the amount you withhold from payments to the employee.

Can I fill out tax forms electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Which IRS forms Cannot be filed electronically?

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax file declaration in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tfn form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete tax file number declaration form 2025 online?

pdfFiller has made it easy to fill out and sign ato tax file declaration form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit tax file form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like online tax file declaration form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is AU NAT 3092?

AU NAT 3092 is an Australian taxation form used for reporting certain taxation-related information to the Australian Taxation Office (ATO).

Who is required to file AU NAT 3092?

Individuals and entities that meet specific criteria set by the ATO, including those involved in certain financial transactions, are required to file AU NAT 3092.

How to fill out AU NAT 3092?

To fill out AU NAT 3092, the taxpayer must provide personal details, financial information, and any other relevant data as specified in the form's instructions.

What is the purpose of AU NAT 3092?

The purpose of AU NAT 3092 is to facilitate the accurate reporting of financial transactions to ensure compliance with Australian tax laws.

What information must be reported on AU NAT 3092?

Information that must be reported on AU NAT 3092 includes taxpayer identification details, income, expenses, and any other relevant financial data as required by the ATO.

Fill out your AU NAT 3092 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tfn Declaration is not the form you're looking for?Search for another form here.

Keywords relevant to tax declaration form for employees

Related to tax declaration form download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.