Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

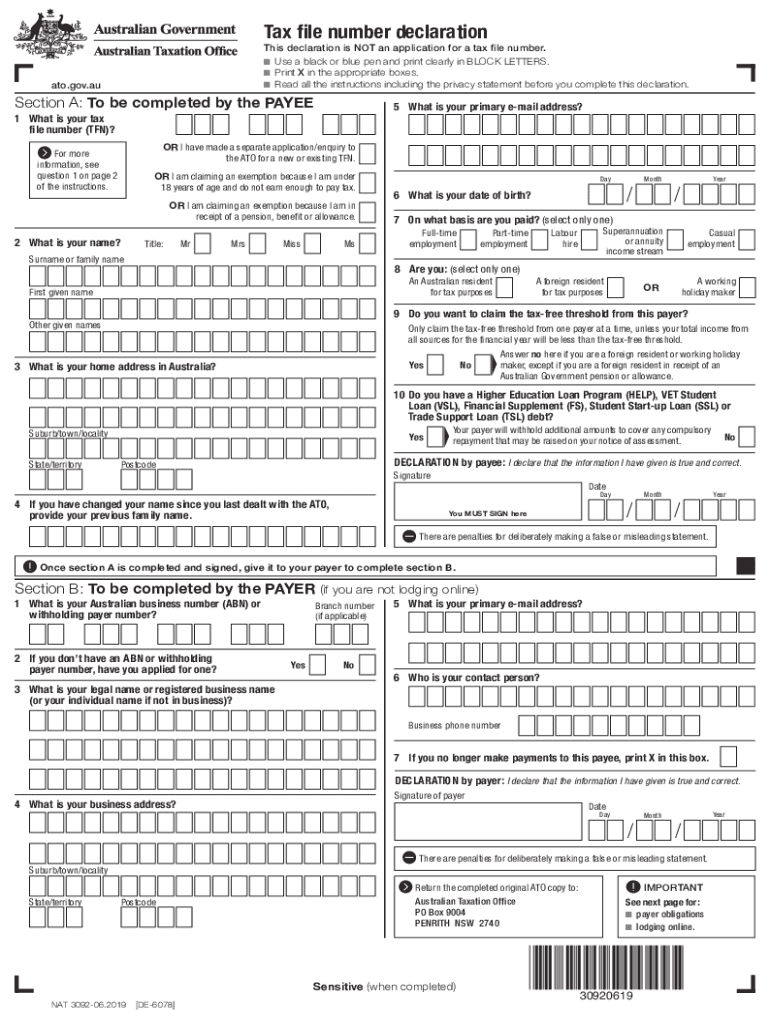

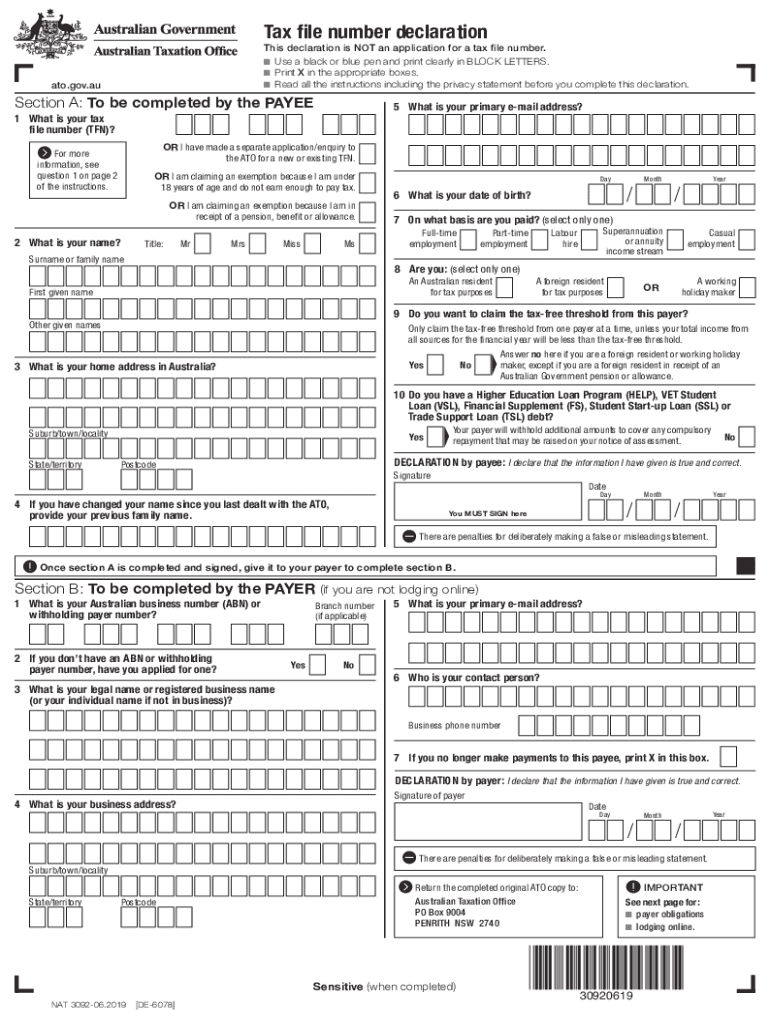

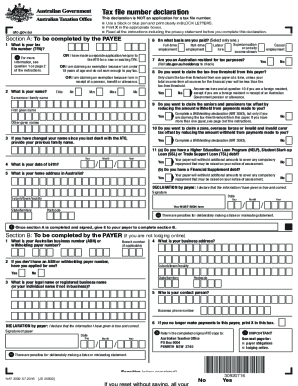

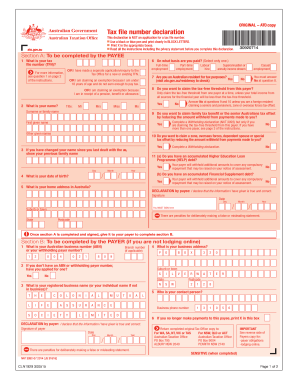

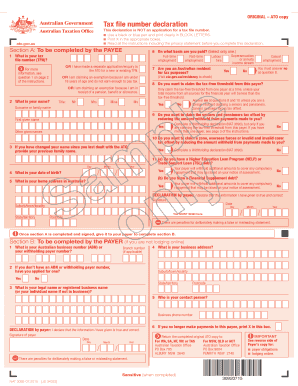

What is tax file declaration form?

A Tax File Declaration (TFD) form is a document that an employer issues to an employee when they start a new job. It is used to determine the level of tax to be deducted from an employee’s salary or wages. The form contains information such as income, address, and any exemptions or deductions that the employee may be entitled to. The information provided on the form is used to calculate the amount of tax to be deducted from the employee's wages.

Who is required to file tax file declaration form?

Anyone who has earned income in the United States is required to file a tax return. This includes individuals, corporations, partnerships, estates, and trusts.

How to fill out tax file declaration form?

1. First, make sure you have all of the necessary documents and information needed to fill out the form. This includes your personal information, income information, and any deductions or credits you plan to claim.

2. Locate the form. You can find the Tax File Declaration Form (TFD) online at the Australian Taxation Office (ATO) website or you can pick up a copy from your local ATO office.

3. Complete the personal information section of the form. This includes your name, address, date of birth, and tax file number (TFN).

4. Fill in the income information section. This includes your gross salary or wages, any income from investments, and any foreign income.

5. List any deductions or credits you are claiming. This includes any work-related expenses, donations, and any other deductible expenses.

6. Calculate your total taxable income. This is the amount of money you will be taxed on.

7. Sign and date the form.

8. Submit the form to the ATO. You can do this either online or by mail.

What is the purpose of tax file declaration form?

The Tax File Declaration (TFD) form is used by employers to collect tax file number (TFN) information from their employees for lodgment with the Australian Taxation Office (ATO). It is important to ensure that the TFN is correctly recorded, as this is used by the ATO to determine the amount of tax that should be deducted from an employee's salary or wages. By providing their TFN, employees can ensure that they are not taxed at a higher rate than they should be.

What information must be reported on tax file declaration form?

The information that must be reported on a tax file declaration form includes:

• Personal details, such as your name, address, date of birth and tax file number (TFN).

• Your employment details, such as your employer's name, address and ABN.

• Your income details, such as salary, wages, allowances, tips and commissions.

• Your investment details, such as dividends, interest and rental income.

• Your tax offsets and credits, such as the low income tax offset.

• Your superannuation details, such as contributions and benefits.

• Any other income you earn, such as foreign income or government payments.

• Any deductions you are entitled to, such as work-related expenses, gifts or donations.

• Any tax credits you are eligible for, such as the medical expense tax offset.

• Your payment details, such as your bank account details.

When is the deadline to file tax file declaration form in 2023?

The deadline to file tax returns in 2023 is April 15th, 2023.

What is the penalty for the late filing of tax file declaration form?

The penalty for the late filing of tax file declaration form depends on the amount of taxes owed. In the United States, the Internal Revenue Service (IRS) can assess a penalty of up to 25% of the unpaid taxes for late filing. However, if the taxpayer is able to show reasonable cause for the late filing, then the penalty may be waived.

How do I modify my tax file declaration form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax declaration form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete tfn declaration form online?

pdfFiller has made it easy to fill out and sign tfn declaration form pdf. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit tax declaration form pdf on an Android device?

The pdfFiller app for Android allows you to edit PDF files like tax file number declaration form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.